Surveys

Advisors Worldwide Optimistic About Private Markets

Adams Street Partners 2025 Advisor Outlook highlights rising demand for access to private markets. A question is whether this appetite can be sustained through turbulence in listed equities, as at present.

A new report by Chicago-headquartered Adams Street Partners, a private markets investment firm with more than $62 billion in assets under management, shows that the shift towards private markets is accelerating as wealthy individuals seek diversified investment opportunities.

The report, entitled The Rise of Private Wealth in Private Markets, presents insights from over 100 financial advisors across North America, Europe, and Asia. Fieldwork was carried over six weeks leading into 2025.

These are challenging times for private markets as listed equities turn volatile, accentuated by the US tariffs policy shifts. The exit routes private equity funds seek – such as initial public offerings (IPO) of companies – are arguably more difficult to execute in such times. Also, trade sales and corporate deals can be tougher to execute. Stocks in Blackstone, a major private equity player, slid last week and are down more than 8.5 per cent over the past month. Carlyle Group, another listed PE house, is down more than 14 per cent on the stock market, and KKR is down 9.5 per cent.

Despite this, respondents in Adams Street survey cite growing client demand for private market exposure, with 92 per cent expecting the asset class to outperform public markets over the long term, the firm said. In turn, 67 per cent anticipate an increase in the percentage of clients with an allocation to the asset class over the next three years.

“Private markets are becoming an essential part of a well-diversified portfolio, and financial advisors are on the front lines of this shift,” said Jim Walker, partner and global head of wealth at Adams Street. “Adams Street is focused on equipping advisors with access to institutional-quality origination, education, and a range of structures to help meet client goals. As an employee-owned firm with significant assets invested alongside our clients, we are deeply aligned with those we serve.”

While complexity, limited access, and tax reporting preferences have historically limited private market participation, advisors report progress in addressing those barriers, the report shows. Structures such as semi-liquid evergreen funds and digital platforms, along with an increasingly favorable regulatory environment are expanding the reach of private investments. As a result, the wealth management market has emerged as a fast-growing source of private markets capital. Individual investors account for about $2.7 trillion, or one-fifth, of the $14 trillion in private market assets under management, according to Morgan Stanley. This is projected to rise to 37 per cent within five years, signaling a profound shift in capital flows and a growing democratization of private markets investing.

“Individual investors are playing an increasingly vital role in the evolution of private markets,” said Jeffrey Diehl, managing partner and head of investments at Adams Street. “As access expands and product innovation accelerates, we see a meaningful opportunity to deliver differentiated returns through high-quality private equity and private credit investments – strategies traditionally reserved for institutional portfolios.”

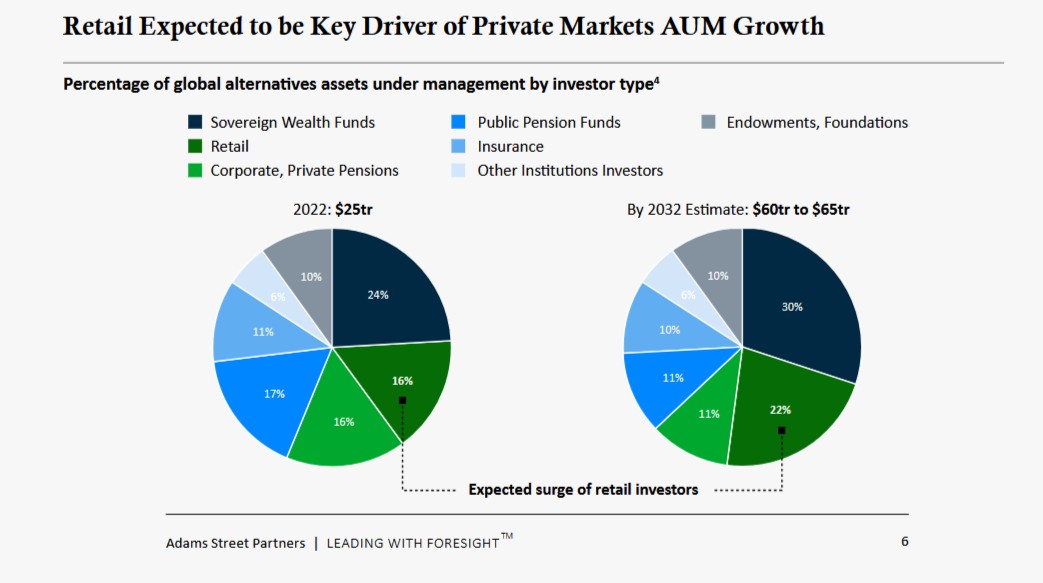

Changing slices of the pie

Source: Adams Street Partners

Evergreen

The report shows that evergreen structures are gaining traction,

with 44 per cent of advisors preferring them to traditional

closed-end funds (37 per cent). Over half cite broader client

access as a primary benefit of these vehicles.

Sixty-nine per cent of advisors also believe that the complexity of private markets makes it difficult to communicate effectively with clients. Forty-nine per cent rate their own expertise as “advanced” – while client understanding trails, with 32 per cent of advisors reporting that their clients have “advanced knowledge.”

Technology is seen as a key investment sector in 2025 for 58 per cent of advisors, followed by financial services (42 per cent), the report reveals. North America-based advisors report that clients prioritize wealth preservation and tax efficiency, while those in Europe emphasize access to new investment opportunities. In Asia, advisors highlight private markets’ ability to drive income and diversification.

Advisors also expect artificial intelligence to transform their engagement with clients, predicting enhancements in risk management (52 per cent), market forecasting (48 per cent), and operational efficiency (48 per cent), the survey shows.

Is the private market story overhyped and due for a period of consolidation, or even retreat? So far, it appears skeptics are hard to find. Steven Tredget, partner at UK-based Oakley Capital, thinks the sector is far from having peaked, although the past couple of years have not been particularly easy. (See this interview.) Blackstone's survey also reveals strong advisor interest in private markets, with 81 per cent planning to introduce them to clients for objectives such as capital appreciation, income generation and diversification. The US-listed funds giant has been pushing in private marktets for some time.

In other examples of surveys, Paris and Boston-headquartered Natixis Investment Managers, which has over $1.3 trillion assets under management, also recently released a new wealth industry survey showing that 92 per cent of respondents plan to increase (50 per cent) or maintain (42 per cent) of their private credit offering. Similarly, 91 per cent plan to increase (50 per cent) or maintain (41 per cent) private equity investments on their platforms.

Adams Street Partners, which has offices in a host of US cities and countries, provides wealth managers and financial advisors access to private markets knowledge and investment solutions. The firm, which was founded over 50 years ago, manages over $62 billion for clients across private equity and venture capital funds, secondary, growth equity, buyout and venture co-investments, and private credit strategies.