Art

"Resilience" Art Market Watchword - UBS Half-Year Review

Dealers, remaining highly valued by investors, are weighing the impact of digital art on their business models. Large galleries and Asian buyers boosted overall sales, with women and Millennials among the most active high net worth collectors.

The latest review of the global art market by Art Basel and UBS saw a slim majority of dealers (51 per cent) reporting increased sales in the first half of 2021 compared with the same period in 2020, and overall sales in the sector were up by 10 per cent.

Asian dealers reported the biggest boost in sales, increasing an average 18 per cent over 12 months, including a 6 per cent rise for businesses in Greater China. The poorest performance was reported by dealers in Europe, with an average 7 per cent drop in sales.

Cultural economist and report author Clare McAndrew found that dealers were more upbeat about their businesses recovering and continuing to adapt as the market continued to weather the effects of the pandemic.

McAndrew’s six monthly review entitled Resilience In The Dealer Sector is based on the activity of 700 global dealers across five markets, focused largely on sales and employment trends for the first half of 2021.

The report found that job losses suffered in 2020 have revived this year, returning average employment in the sector to 2019 levels. The majority of dealers (78 per cent) predicted that their employment numbers would remain stable for the rest of the year, with only 4 per cent expecting further layoffs. Just under a fifth were looking to hire, and this was most notable among the largest galleries, with turnovers in excess of $10 million.

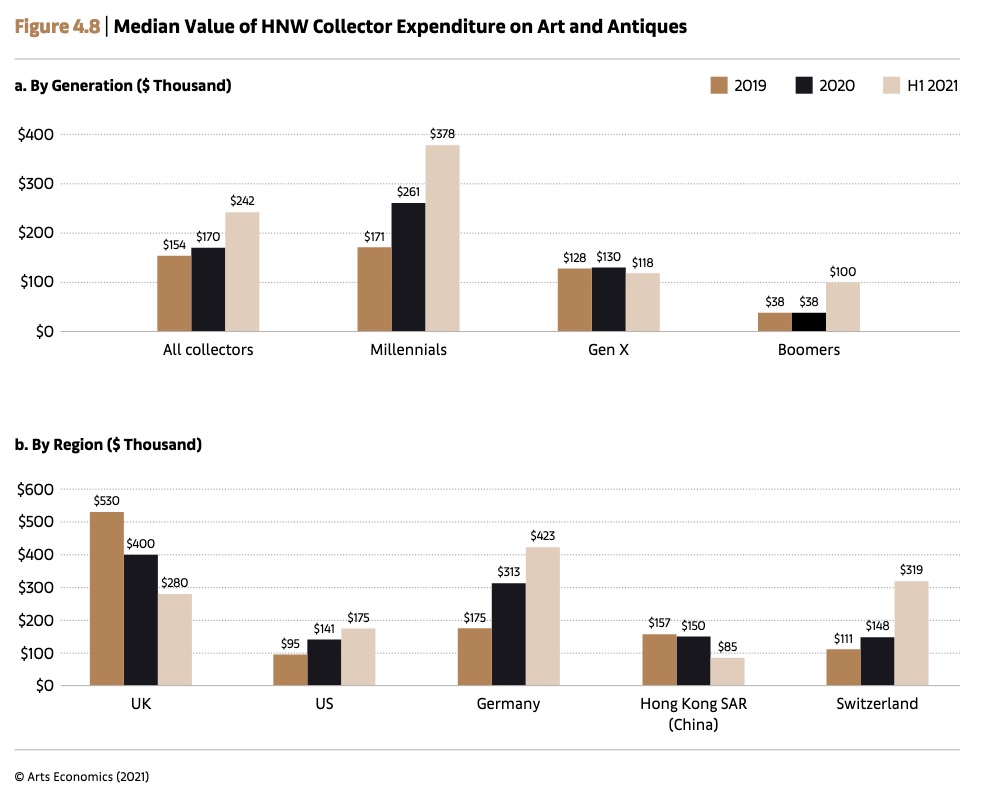

A separate survey of 500 high net worth collectors for the UBS Investor Watch and Arts Economics report, showed that HNWs have increased their median expenditure on art and antiques by 42 per cent, spending an average $242,000 in the first half of 2021. This increase was largely credited to Millennial buyers, who spent more than three times more than their older peers.

The following graphics show the art purchasing trends of HNWs by demographics and region.

A tendency to "buy from who you know" continues to be the theme for 2021, with the majority (57 per cent) of HNW collectors only buying from familiar galleries.

"Although the art fair calendar remains disrupted, survey results indicate a strong desire among collectors to return to these events, matched by an overwhelming desire on behalf of collectors to buy art in person," Noah Horowitz, Americas director for Art Basel said, identifying a couple of the returning trends.

Female HNW collectors were shown to be outspending their male counterparts, and have been on a much faster spending trajectory over the last couple of years. Not surprisingly, close to half the collectors surveyed (48 per cent) said they were interested in buying digital art works in the next 12 months.

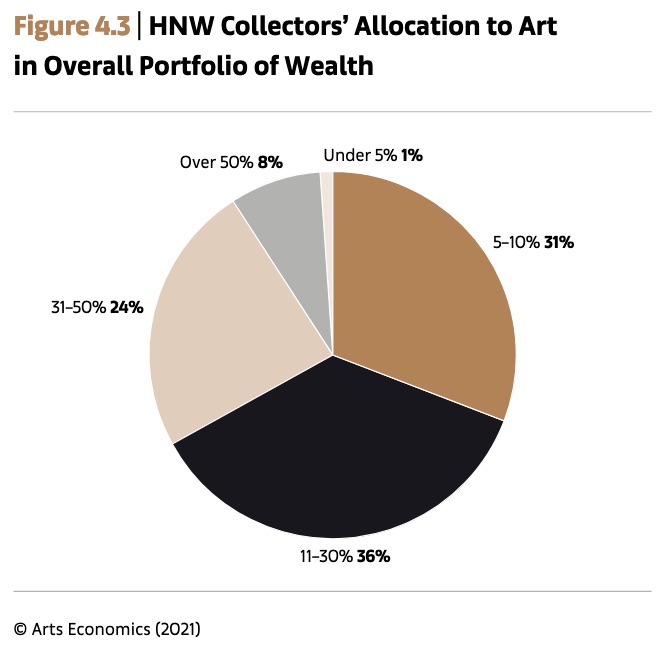

This area of the market has generated the most excitement in investment circles as interest grows in digitising works and offering fractional ownership through non-fungible tokens, or NFTs, a practice that is becoming more accepted as art continues to widen its appeal as an asset class.

"Digital art entered centre stage this year. The non-fungible token craze catapulted this in the public consciousness, but the roots are deeper yet, with collectors expressing a broad-based interest in digital art, film, and video work as part of their collecting purview nowadays," Horowitz said.

McAndrew noted that a critical part of her future research will

be assessing sales outside the conventional art trade, and

tracking how sales made by dealers and auction houses currently

compare with those outside these institutions, directly from

artists and between collectors and other new agents, as the range

of ways for viewing and buying art expands.

Sustainability is also increasing art patrons’ interests and priorities, with three quarters of collectors surveyed saying that they now consider sustainable options when purchasing art or managing their collections.

Among HNW collectors surveyed in the five main US, UK, Hong Kong SAR (China), Germany, and Switzerland markets covered by the report, UK collectors were the most optimistic about further recovery in the next six months.

On average, UK collectors bought from 13 different galleries in the first half of 2021 (down from 19 in 2020), with three-quarters saying that they prefer to buy locally; and just 16 per cent preferring to buy from overseas.

Across all five regions, 60 per cent of collectors said they plan to make a purchase in the next 12 months.